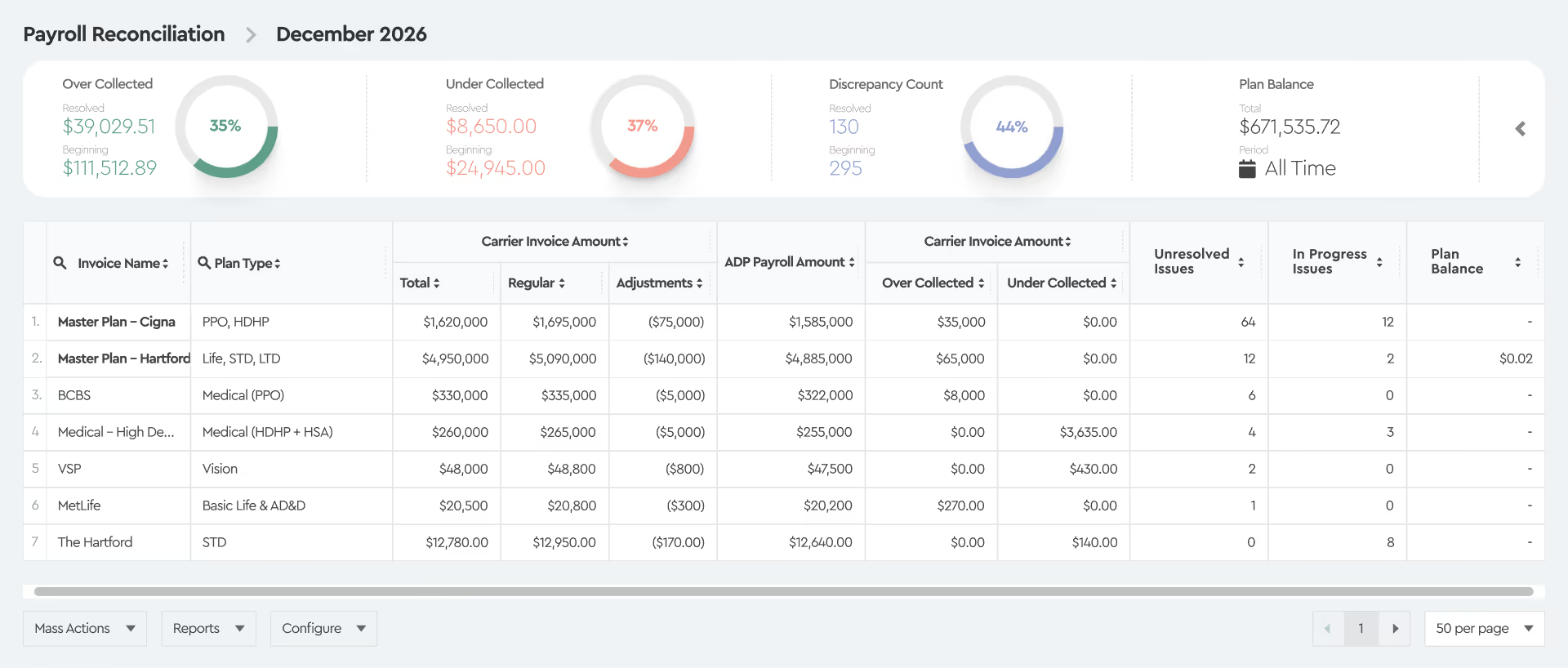

Benefits reconciliation starts by uploading your source data. Tabulera integrates with systems like Workday, PrismHR, isolved, and Employee Navigator - so if you’re connected, all you need to upload each month is your carrier invoice.

Tabulera supports two types of reconciliation:

- Carrier invoice vs. enrollment and COBRA data

- Carrier invoice vs. payroll and COBRA data

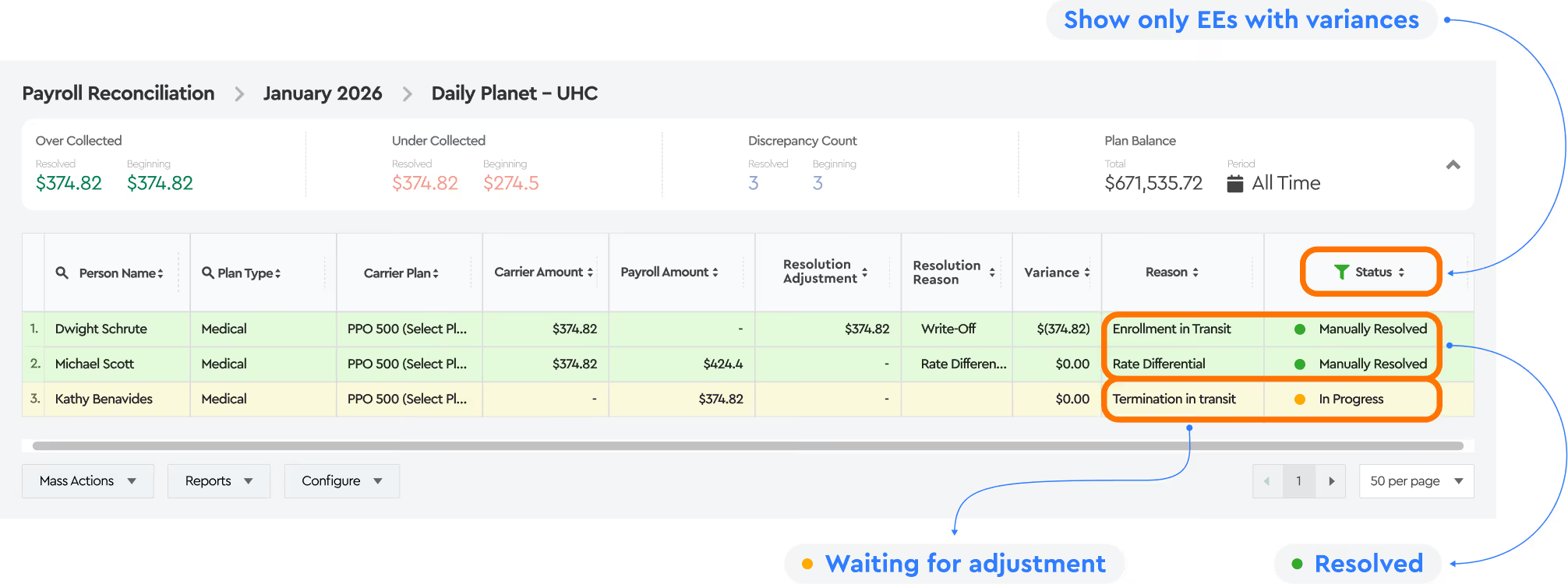

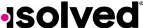

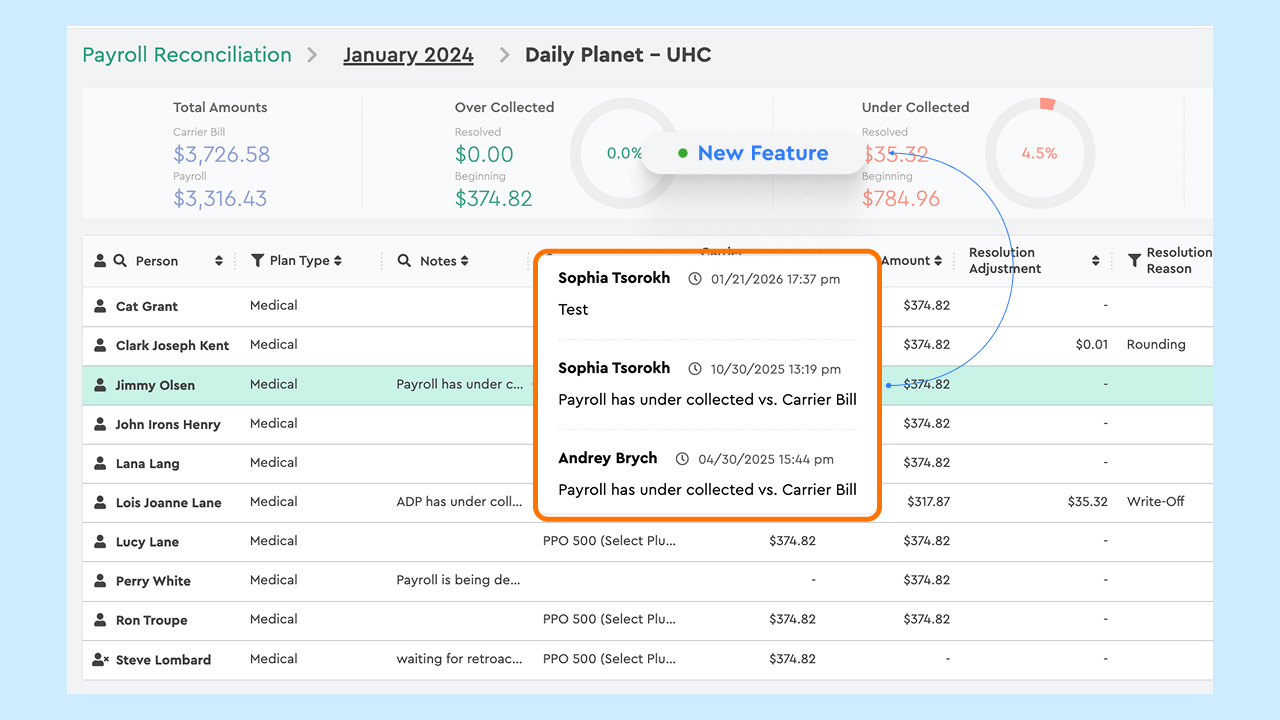

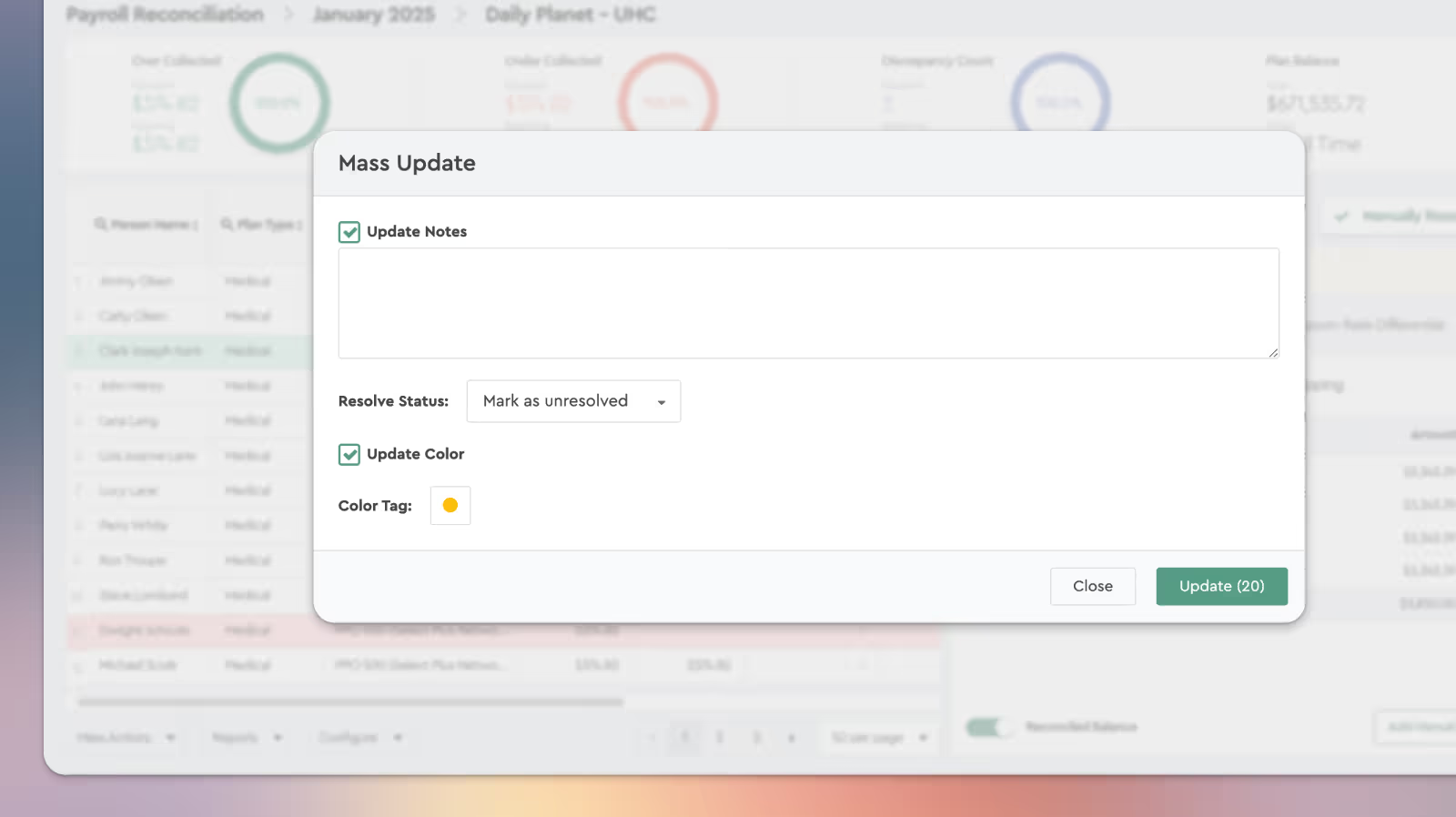

Unlike other tools, Tabulera doesn't require invoice consolidation. Each invoice is reconciled separately.Once inside the invoice view, Tabulera filters out employees with no discrepancies and auto-resolves simple cases like rounding issues. It supports multiple pay frequencies and auto-categorizes variances to help you prioritize faster.

Clicking on any employee reveals their full plan balance history—every transaction since the start of coverage—so you can track down the cause of an issue without leaving the platform. You can also make manual adjustments if needed based on internal policy.When you're done, Tabulera generates clean reports for your finance team.