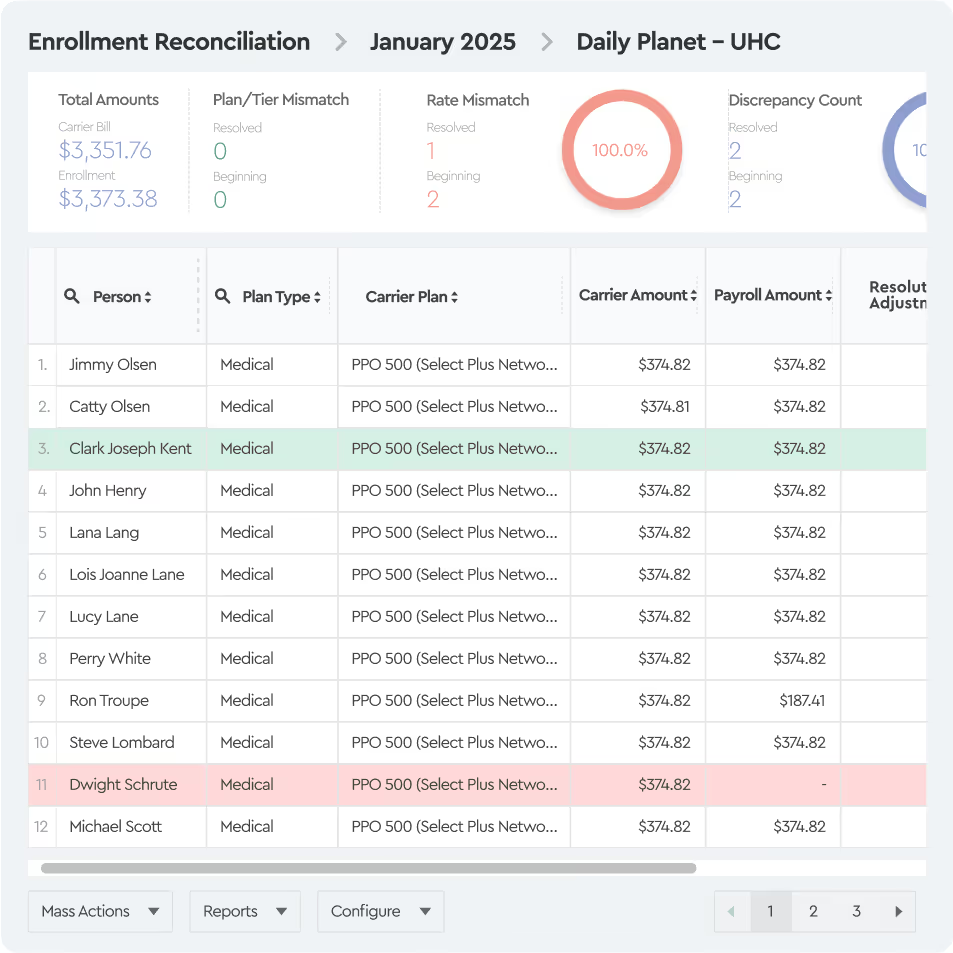

Tabulera is integrated with Employee Navigator and automatically pulls enrollment data into the platform - no file uploads or manual mapping required.

If your clients are reconciling their own invoices, they should start by creating a free 30-day trial account. During setup, they select Employee Navigator as their enrollment source and ask you to activate the integration in the Marketplace.

If you are offering reconciliations-as-a-service, you should enable the integration for each client you reconcile.

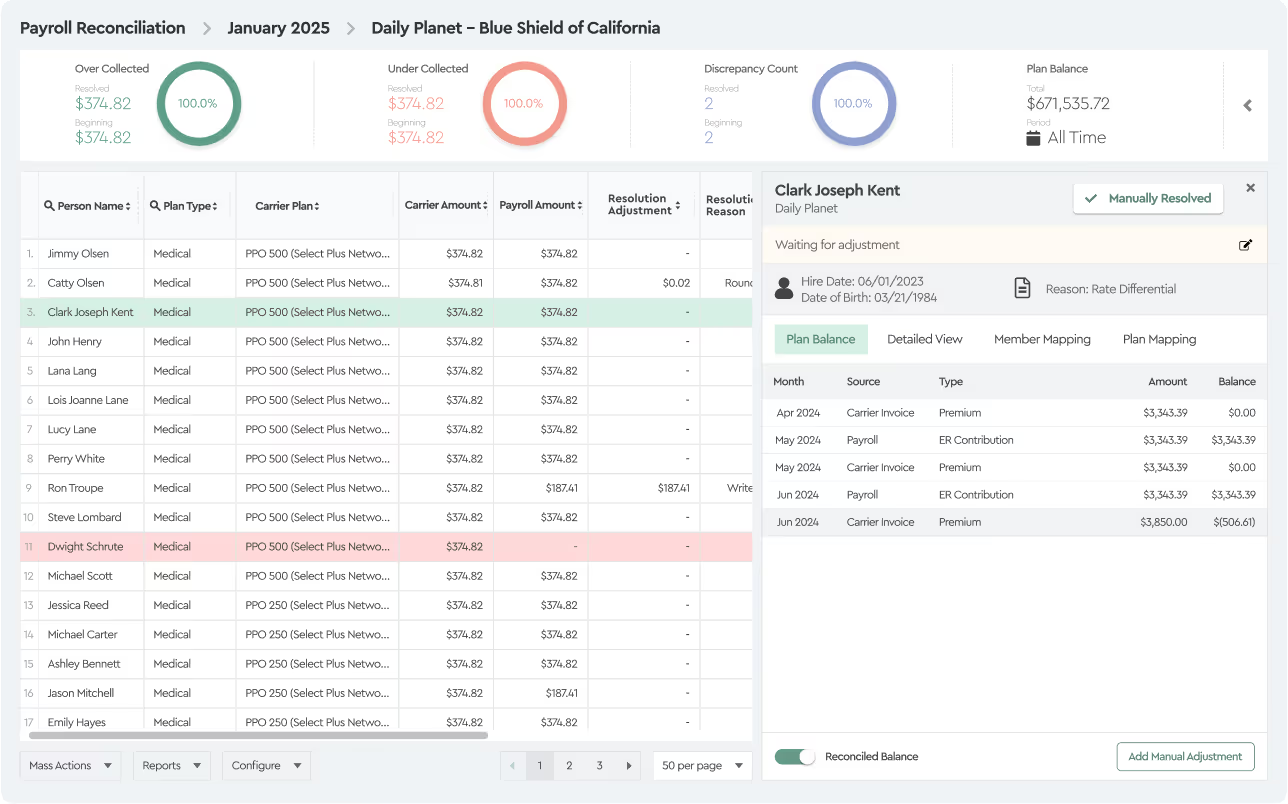

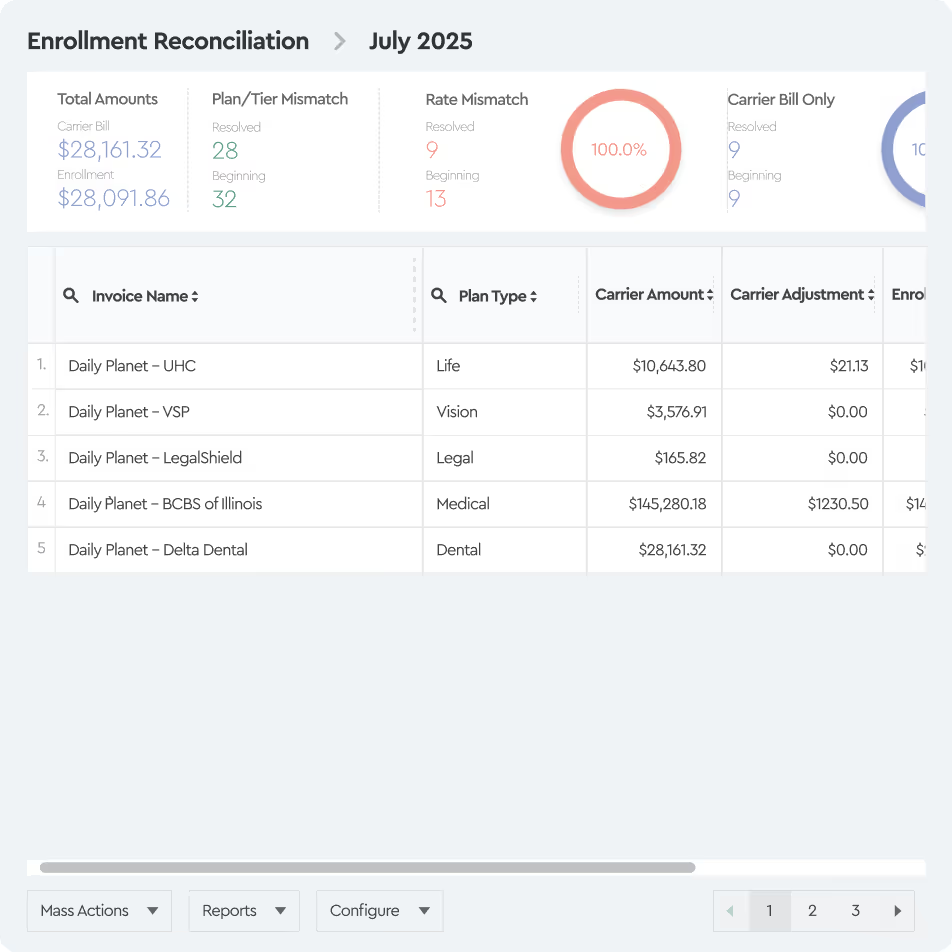

Reconciliation Software for Benefit Brokers and clients

Tabulera helps agencies and benefit brokers expand their offering, automate premium invoice reconciliation, and increase client satisfaction.