July 11, 2023

Enrollment versus Payroll Reconciliations. Which Works Best for your Company?

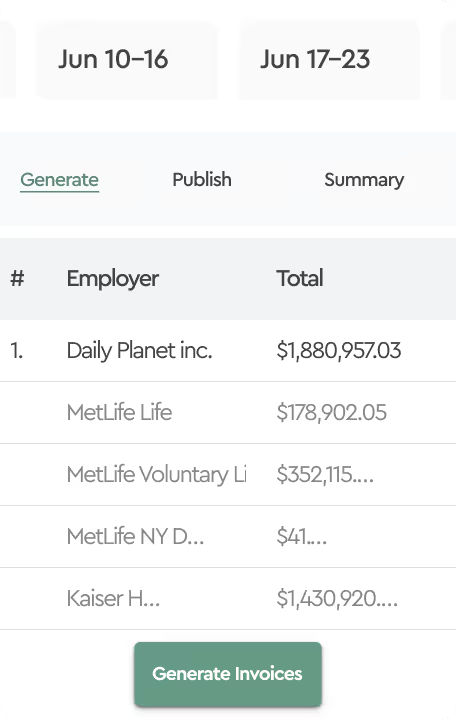

In the world of employee benefit administration, nothing is more dreaded than the monthly task of attempting to reconcile insurance carrier invoices. When we asked benefit managers, directors and VPs what they compare during the reconciliation process, we received puzzled looks. Let’s look at two common approaches to carrier invoice reconciliations. While Insurance carriers provide a 30-day payment grace period, most request payment and mark invoices “Due” on the first day of the insurance coverage period. In other words, insurance invoices are generated up to a few weeks in advance of the month of coverage but payable on the first day of coverage.

Enrollment Reconciliations

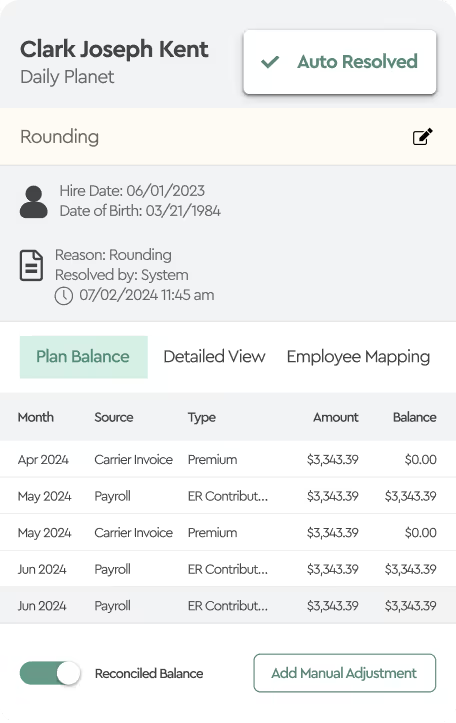

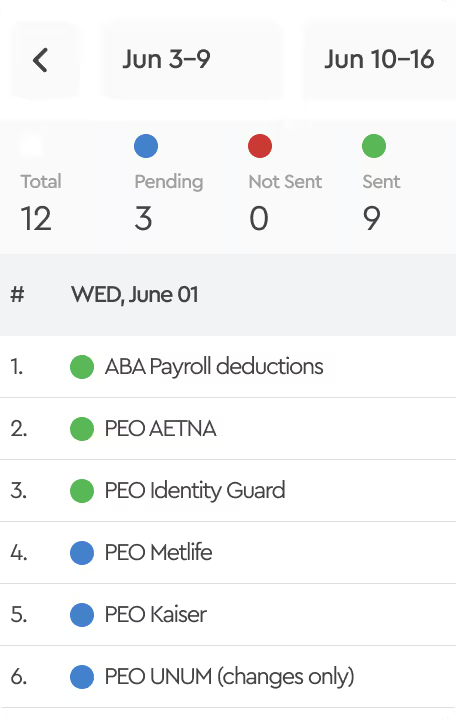

In the reconciliation process, the first step should involve aligning people and premiums with your benefits enrollment platform. This essentially requires a comparison of the plans employees have elected in your enrollment platform against what carriers reflect on their invoices. An enrollment reconciliation is an excellent first step to identify timing differences, such as new hires or terminations, for events that occur after the statement generation date. This step can be accomplished even prior to the payment of premiums.

Payroll Reconciliations

If your company pays 100% of all insurance coverage and makes no cost sharing arrangements via payroll deductions for employees, which is rare these days, then you can skip the payroll reconciliation process. More likely your second step is to reconcile the amount of premiums employees should be reimbursing your company as the plan sponsor for any cost-sharing premium arrangements. For instance, if your company as the plan sponsor pays for 75% of the employee only premium and the employee is responsible to reimburse the plan for the other 25%, then these amounts should be reflected with the appropriate payroll deductions.

Performing both an enrollment and payroll reconciliation assures that at the end of the day, you as the plan sponsor are not overpaying for premiums by leaving terminated employees on the invoice. Perhaps worse yet, also double checking that employees haven’t been accidentally dropped from coverage or were missed from being enrolled. Both of these reconciliation processes need to take into account COBRA plan enrollments and COBRA reimbursements as this can be a big benefit leakage area as well since these ex-employees may still be on the carrier invoices.

Insurance Carrier Correction Period

Unlike other vendor relationships, where you might find a mistake and a vendor will retroactively correct, insurance carriers usually allow only a 60 to 90 day look back period for corrections that could be attributed to the plan sponsor. This rule is not unreasonable given that carriers may be paying out claims due to the error of a plan sponsor.

Which One Works Best

Reconciling enrollment transactions to the carrier invoice is an important step before you pay your invoice but of course doesn’t ensure that your payroll platform is taking the appropriate deductions. Payroll reconciliations maybe a better way to look at the outcome for a month but can only be completed after the coverage period month ends since payroll deductions are actively processing until the last day of the coverage month. This puts you as the plan sponsor in a tough spot to quickly identifying and resolve discrepancies before the correction period expires. This may be difficult if you’re a large employer with high turnover.

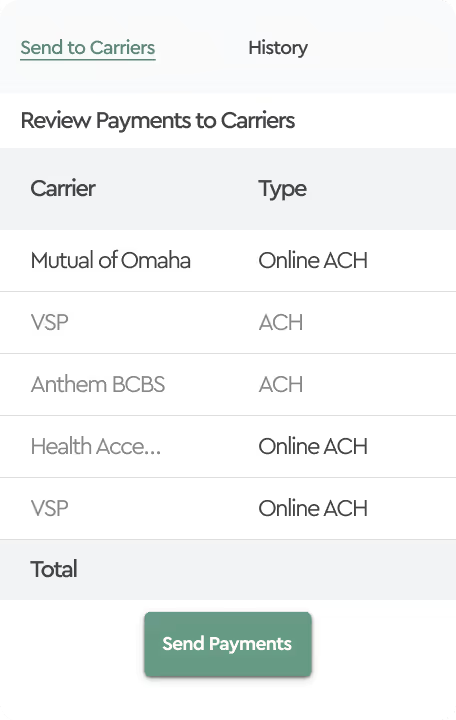

The right answer maybe is to look at both processes as independent of each other that validate different steps in the Benefit Premium Administration process, the results of each reconciliation can, however, be mutually leveraged. Using both your benefit team and your accounting teams and these two processes you should be able to provide a high level of reliability that you as the plan sponsor are covering the right people, paying the appropriate premium and receiving the right employee reimbursements.