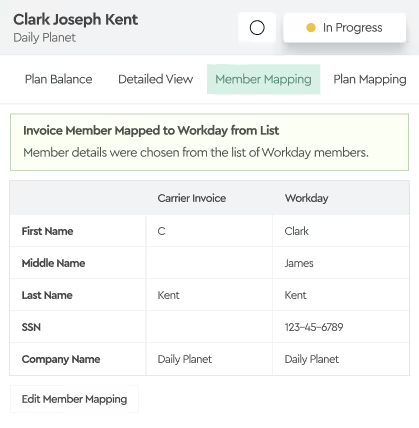

Yes. The integration supports both list-billed and self-billed plans within the same reconciliation process.

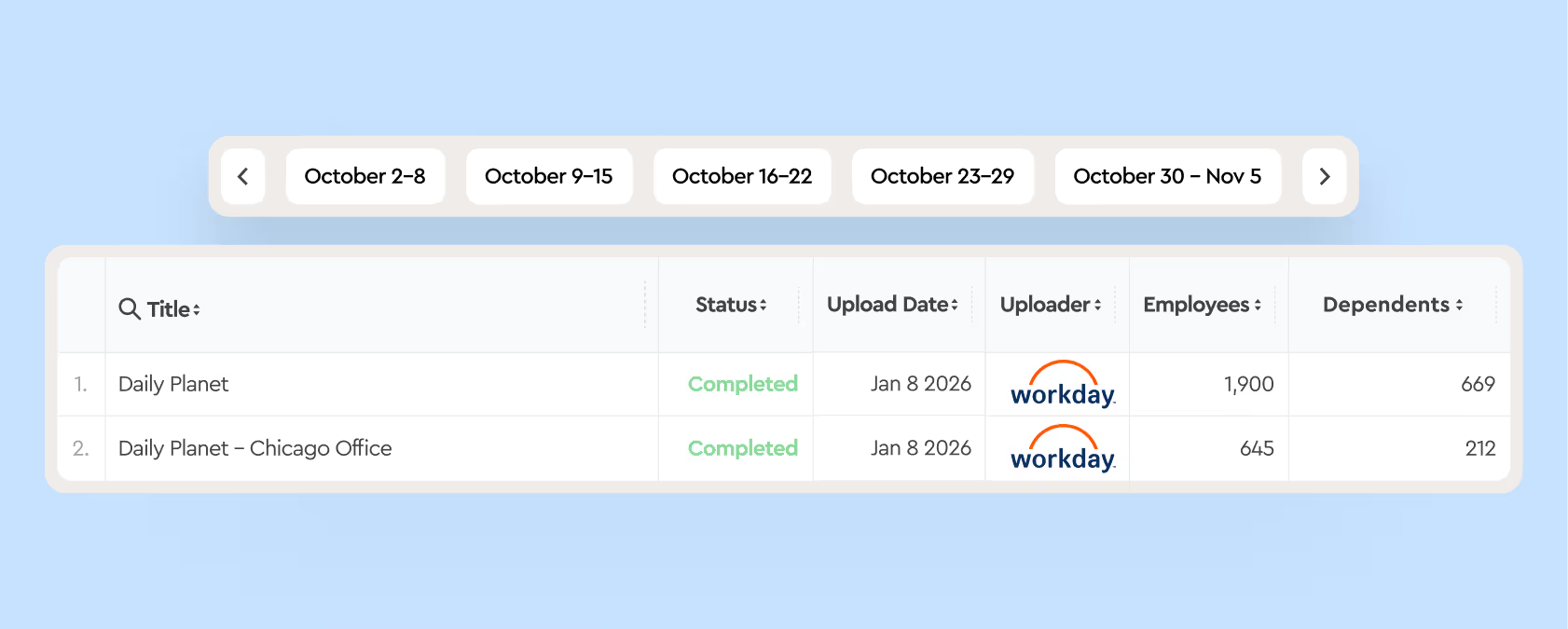

Workday Integration for Benefits Reconciliation

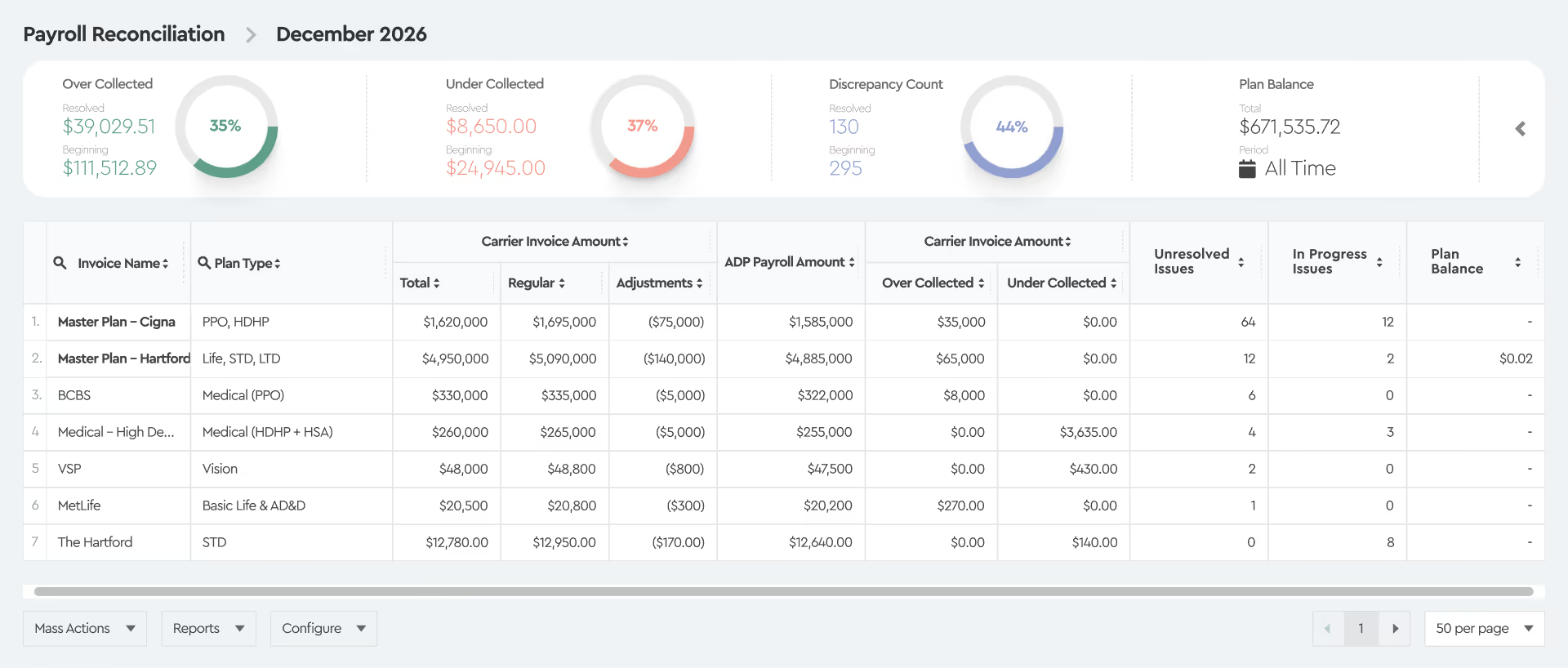

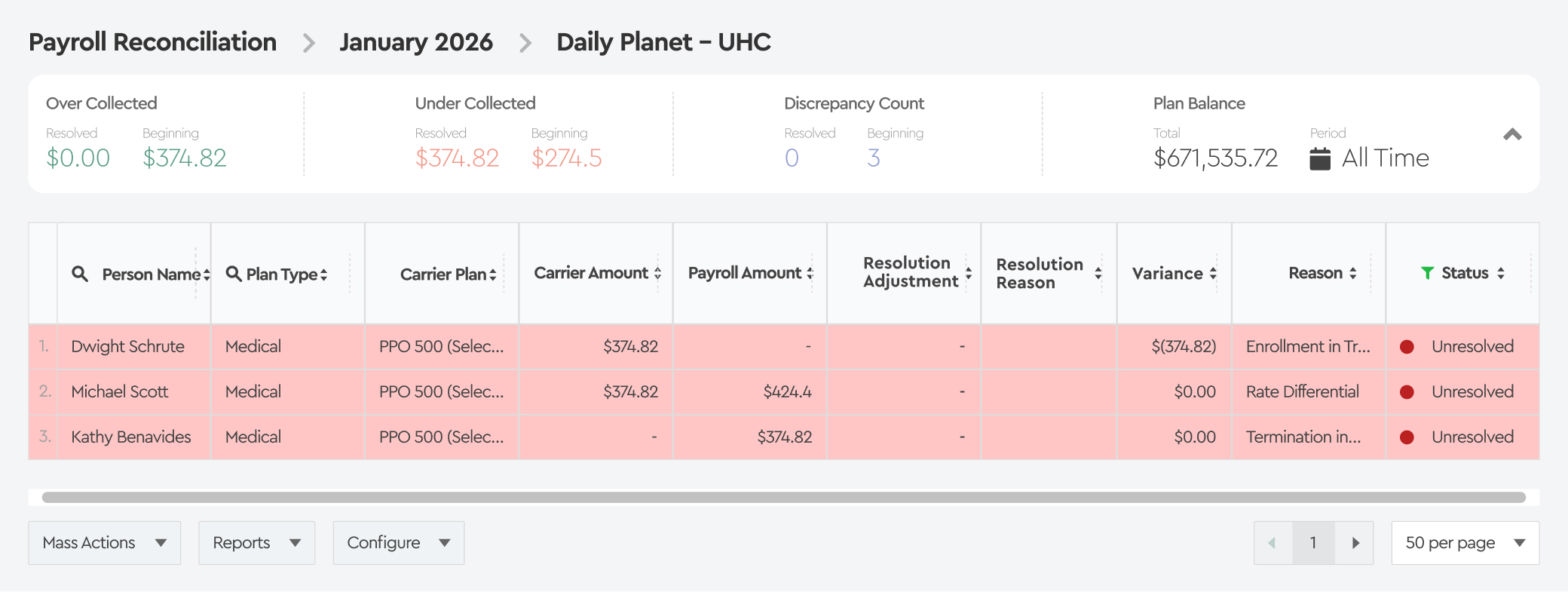

protect benefit spend

Tabulera’s Workday integration helps teams find and resolve benefits billing variances faster