January 20, 2026

Employee Benefits Brokers: How do Brokers make Money?

Understanding how employee benefits brokers are paid is essential for HR leaders evaluating their benefits strategy. Broker compensation can influence costs, service levels, and the recommendations you receive, making transparency and disclosure a key factor in long-term value.

This guide explains how benefits brokers make money, covering commission-based, fee-based, and hybrid compensation models, and what each means for your organization.

What Is an Employee Benefits Broker?

An employee benefits broker is a licensed professional who helps employers design, purchase, and manage employee benefit plans such as health, dental, vision, life, and disability insurance. Beyond selling insurance, brokers advise on plan strategy, compliance, renewals, vendor selection, and ongoing benefits administration - often acting as a long-term partner to HR and finance teams.

How Do Employee Benefits Brokers Make Money?

Employee benefits brokers typically earn money through a combination of commissions, employer-paid fees, or both. The right model depends on the size of the employer, the complexity of the benefits program, and the services provided. Understanding these structures helps employers and brokers evaluate transparency, incentives, and overall value.

Carrier-Paid Commissions

The most traditional compensation model is carrier-paid commissions. In this setup, insurance carriers pay brokers a percentage of the premiums for each policy sold and maintained.

For medical plans, broker commissions typically range from 2% to 8%, depending on the carrier, plan type, and group size. Dental, vision, life, and disability plans often have higher commission percentages, though the overall dollar amounts are smaller due to lower premiums.

Pros for employers:

- No direct invoice from the benefits broker

- Costs are bundled into premiums

Cons to be aware of:

- Compensation is less visible

- Employers may not realize how broker incentives are structured

This model has been the industry standard for decades, but transparency concerns and legal disclosure requirements (CAA 2021) have pushed many organizations to explore alternatives.

Fees Paid by Employers

Under a fee-based broker model, employers pay benefits brokers directly for their services rather than relying on commissions.

Common fee structures include:

- Flat annual retainers

- Hourly consulting fees

- Per-Employee-Per-Month (PEPM) fees

PEPM fees are especially common among larger employers and BPOs managing multiple clients. For example, an employer might pay a broker a fixed monthly fee per enrolled employee to cover advisory and administrative services.

This approach offers clearer cost visibility and separates broker compensation from carrier pricing.

Hybrid Compensation Models

Hybrid models combine reduced carrier commissions with employer-paid fees. This approach allows brokers to remain competitive while increasing transparency around how they're paid.

Many mid-to-large employers prefer hybrid models because they balance predictable costs with flexibility. It also helps brokers demonstrate that their recommendations aren’t solely driven by commission structures.

Other Revenue Streams

In addition to commissions and fees, benefits brokers may generate revenue through:

- Benefits administration platforms

- Compliance and regulatory consulting

- Open enrollment support

- Data analytics and reporting services

- Wellness and population health programs

These services are often optional but can add significant value when aligned with employer needs.

Additional Revenue Opportunities for Benefits Brokers

As benefits administration grows more complex, brokers are increasingly offering ancillary services beyond traditional plan placement. This may include HR consulting, employee communications, COBRA administration, and technology solutions that streamline enrollment and billing.

For brokers, these services create additional revenue while deepening client relationships. For employers, they can simplify vendor sprawl - but only if services are clearly defined and priced.

The key is transparency. Employers should understand what’s included, what’s optional, and how each service impacts overall benefits costs. When compensation models and services are clear, trust improves on both sides.

Commission-Based vs Fee-Based Brokers: What’s the Difference?

Neither model is inherently better. What matters is whether incentives align with employer goals and whether compensation is clearly disclosed.

How Much Do Benefits Brokers Typically Earn?

Benefits broker earnings vary widely based on:

- Employer size

- Number of employees

- Benefit plan complexity

- Scope of services provided

- Geographic region

For large employers with 500+ employees, broker compensation can range from tens of thousands to several hundred thousand dollars annually, especially when multiple lines of coverage and services are involved. The focus shouldn’t be on the number itself - but on whether compensation reflects real, ongoing value.

Are Employee Benefits Brokers Required to Disclose How They're Paid?

Yes. In the U.S., brokers working with ERISA-covered group health plans are required to disclose their compensation in writing to employers before a contract or renewal. This requirement stems from the Consolidated Appropriations Act (CAA) of 2021, which mandates transparency around broker and consultant compensation.

The disclosure must include:

- All direct and indirect compensation from carriers

- Commissions, bonuses, and override payments

- Fees paid by the employer

- Any other financial arrangements that could create conflicts of interest

What this means for employers:

You have the right to understand exactly how your broker is paid before signing or renewing. If a broker is hesitant to provide clear documentation, that's a red flag.

Full transparency is both a legal requirement and a best practice. It helps employers evaluate the value they're receiving, compare benefits broker proposals accurately, and avoid potential conflicts of interest that could impact plan recommendations.

When to request disclosure:

- Before selecting a new broker

- At renewal time with your current broker

- Anytime you're changing benefit strategies or carriers

- If you suspect your costs don't align with services provided

How Tabulera helps Employee Benefits Brokers

Brokers typically support benefits reconciliation in two ways. Tabulera is designed to fit both models. One model keeps reconciliation with the client. The other makes it a broker-led service.

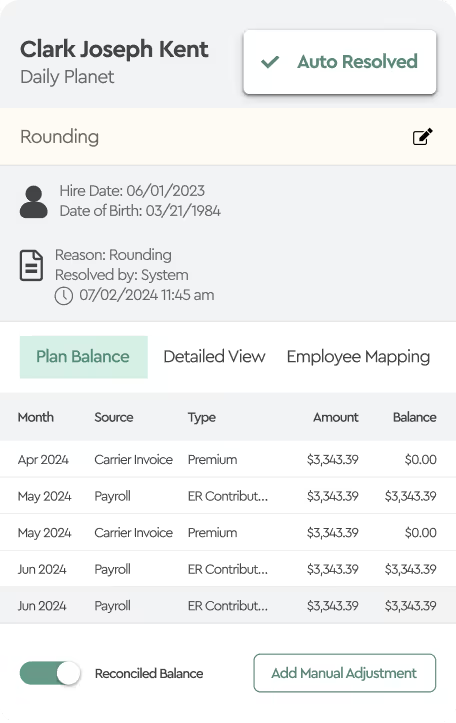

Client-Managed Reconciliation

In this model, the client runs benefits reconciliation internally, while the broker stays supportive rather than operational. Clients use Tabulera to match payroll with carrier invoices and review and explain variances as they appear. This speeds up the reconciliation process and helps catch costly billing variances.

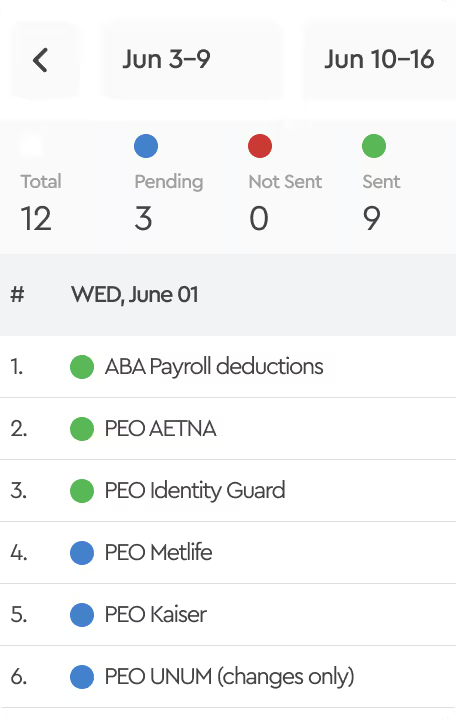

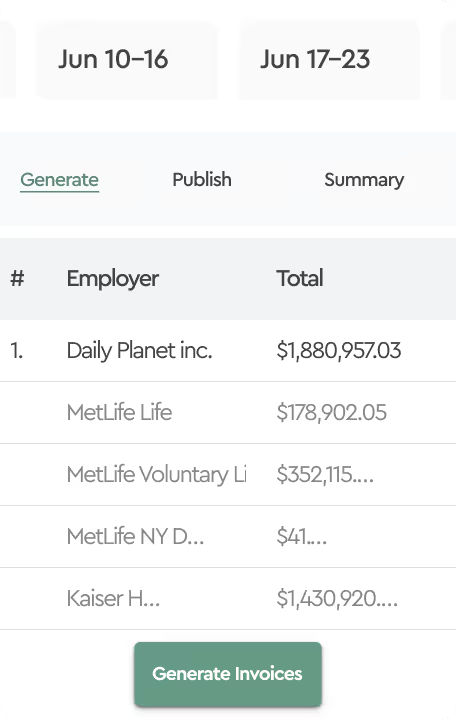

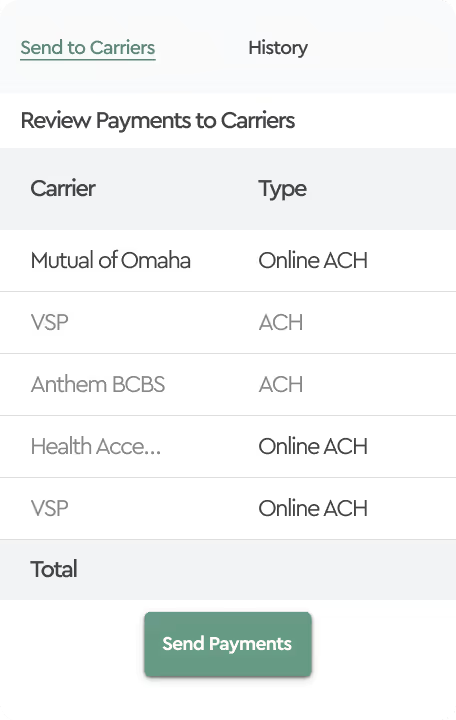

Broker-Managed Reconciliation

In this model, the benefits broker provides benefits reconciliation as an additional service, typically focused on enrollment reconciliation, since brokers own the enrollment data. Tabulera is used to match enrollment data with carrier invoices to catch billing issues early and prevent benefit write-offs for clients. This gives brokers a clear, repeatable way to deliver the service without spreadsheets or custom workflows.

FAQs

What are employee benefits broker commissions?

Employee benefits broker commissions are payments made by insurance carriers to brokers, usually calculated as a percentage of premiums for each policy sold and maintained.

How do benefits brokers get paid?

Brokers are paid through carrier commissions, employer-paid fees, or a hybrid of both, depending on the agreement and services provided.

What’s the difference between commission and fee-based models?

Commission-based models tie compensation to premiums, while fee-based models involve direct payment from employers for defined services.

What is a per-employee-per-month (PEPM) fee for brokers?

A PEPM fee is a fixed monthly amount paid per enrolled employee, offering predictable costs for advisory and administrative services.

Why does broker compensation matter for benefits administration?

Broker pay structures influence incentives, transparency, and decision-making in benefits administration. Commission-based earnings are tied to premiums, though rates and structures vary by contract and carrier.

Under the Consolidated Appropriations Act (CAA) 2021, brokers must disclose all direct and indirect compensation to plan fiduciaries before entering or renewing contracts.

This transparency enables employers to assess potential conflicts of interest and make informed decisions about benefits administration.